- Do u need police report file insurance claim drivers#

- Do u need police report file insurance claim driver#

If the damages caused by the accident were under $2,000 and you didn’t report it, and the other driver did, their insurance company will contact your insurance company, so your own insurance company will find out about it. Those who do not want to make a claim often choose not to report the accident. Generally, people who want a make an insurance claim will bring their vehicle to a reporting centre, and report the accident to the insurance company. What if you don’t tell your insurance company?

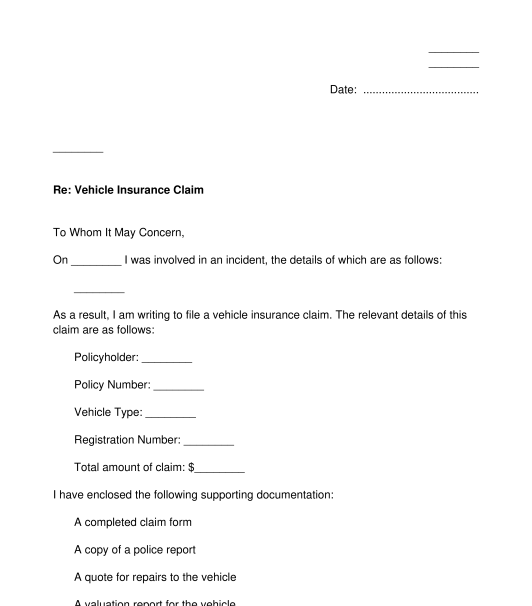

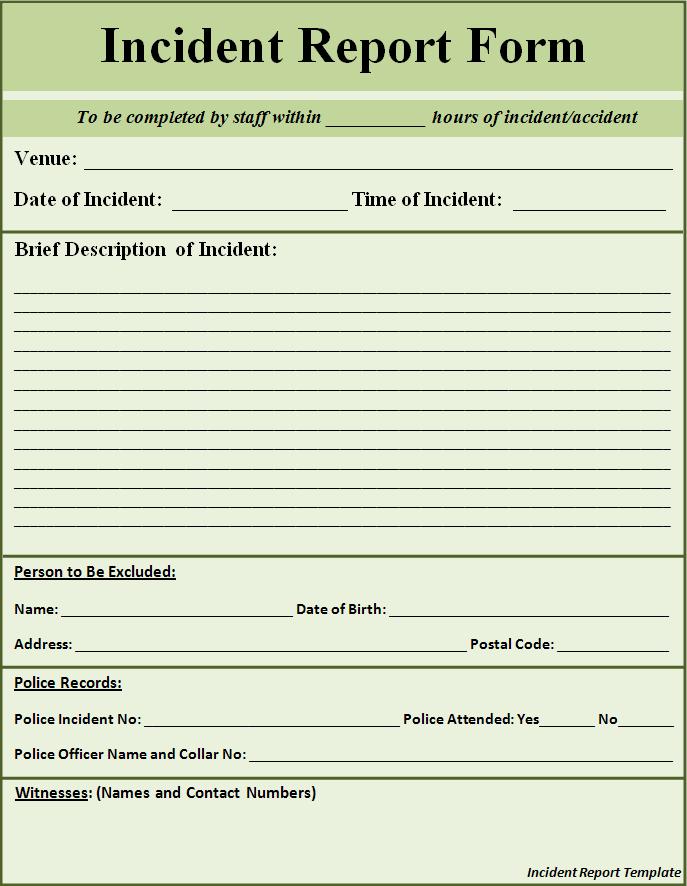

Insurance companies base their rates on “risk” regardless of who pays for the accident. If you are not at-fault, the accident will not count against you and your insurance rate will not increase. Even if you pay for the damages caused by the accident yourself, if the accident was 100% your fault or you were partially at-fault, the accident will count against you. The Collision Reporting Centres are partnerships between the local police services, insurance providers and private enterprise.įor more information and a comprehensive explanation of when you must report a collision to the police, refer to the Toronto Police Service (TPS).Īll automobile insurance policies state that you are required to report all accidents, regardless of the amount of damage. At the Collision Reporting Centre, your vehicle will be inspected and the damage photographed, and you will get assistance with completing a police report. The police do not send these reports automatically to your insurance company. If the accident was reported to a Collision Reporting Centre, the Centre will automatically advise your insurance company, unless you request them not to. If the centre is closed on weekends, you may have up-to 48 hours. The police may require you to wait for them to arrive, or they may instruct you to take your car to a Collision Reporting Centre.Īfter an accident occurs, you are required to bring your vehicle to a Collision Reporting Centre within 24 hours.

Do u need police report file insurance claim drivers#

When someone is injured in an accident, or any of the drivers involved are suspected of a law violation, or there is property damage over $2,000, you are required by law to contact the police before leaving the scene of the accident. Property damage over $2,000, and / or if someone is injured In most cases, you are simply required to take your car to a Collision Reporting Centre. Generally, under these circumstances, police will not attend the scene. The exception to this is if there has been damage done to someone else’s property, such as to telephone poles, guard rails or someone’s lawn. If the accident does not involve personal injury and none of the drivers involved are suspected of a law violation, such as driving while their ability was impaired, and the property damage is under $2,000 (total, combined damage to both vehicles), there is no legal requirement to call and wait for the police. Property damage under $2,000, where no one was injured Call the police, or report to a collision centre If you can do so safely, you should help prevent further accidents by warning approaching traffic, such as putting on your hazard signals, or raising the hood of your vehicle. For example, if a car is burning, you can pull the victim from the car. You should not touch the injured person, unless you have medical training or unless the victim’s needs are clear.

You should call an ambulance if it appears that someone is injured. It is illegal to leave the scene of an accident, whether you were directly or indirectly involved in the accident. Stay at the sceneįirst, you must remain at, or immediately return to the scene of the accident. There are also some things that you should do to legally protect yourself if the accident injures someone or causes property damage. If you are directly or indirectly involved in an accident that causes property damage, bodily injury, or death, there are several things that you are legally obligated to do.

0 kommentar(er)

0 kommentar(er)